Services To Strengthen Your Business

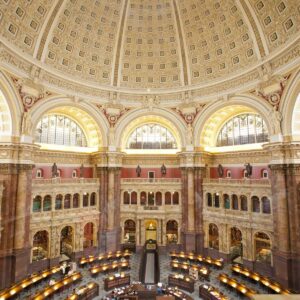

TECHNOLOGY | ACCOUNTING, TAX & AUDIT | BUSINESS ADVISORY

ACCOUNTING, AUDIT, TAX & CONSULTING SERVICES

ACCOUNTING, AUDIT, TAX AND CONSULTING SERVICES

View Services

Technology

SERVICES

Technology

SERVICES

View Services

Business Advisory SERVICES

Business Advisory SERVICES

View ServicesLatest Insights

Latest News

Tax Insight from Jim Brandenburg Featured in WICPA Magazine

Jim Brandenburg’s article, “Voluntary disclosure program for ERC claims,” was published in the Wisconsin Institute of CPAs’ magazine, On Balance. This article discusses the IRS’ Voluntary Disclosure Program for the

Sikich Partners with Symphony Talent to Expand Talent Acquisition Offering for Clients

CHICAGO — March 26, 2024 — Sikich announced today that it has entered into a partnership with Symphony Talent to assist implementation and support services for the company’s software-as-a-service (SaaS)

Sikich Partners with Insurity to Support Digital Transformation for Georgia Stearns Insurance Agency

CHICAGO — March 22, 2024 — Sikich, in collaboration with Insurity – the leading provider of cloud software for insurance carriers, brokers, and MBAs – helped Georgia Stearns Insurance Agency

Sikich Named a Great Place To Work®, Far Exceeding the Industry Average

CHICAGO – March 21, 2024 – Professional services company Sikich has achieved Great Place To Work CertificationTM in the U.S. and India. This is the company’s fourth consecutive year to